New Utah Map Identifies Homes Subject to Wildfire Mitigation Fees

Utah's new law requires homeowners in wildfire zones to pay fees based on a finalized risk map.

UTAH — A new law in Utah mandates that certain homeowners in wildfire-prone regions pay an annual fee, with the state now having finalized a map that designates properties within high-risk wildfire zones. House Bill 48 requires the Utah Division of Forestry, Fire and State Lands to identify areas where urban development intersects with wilderness, referred to as the wildland-urban interface (WUI). Properties identified as being at the highest risk will incur an annual wildfire mitigation fee.

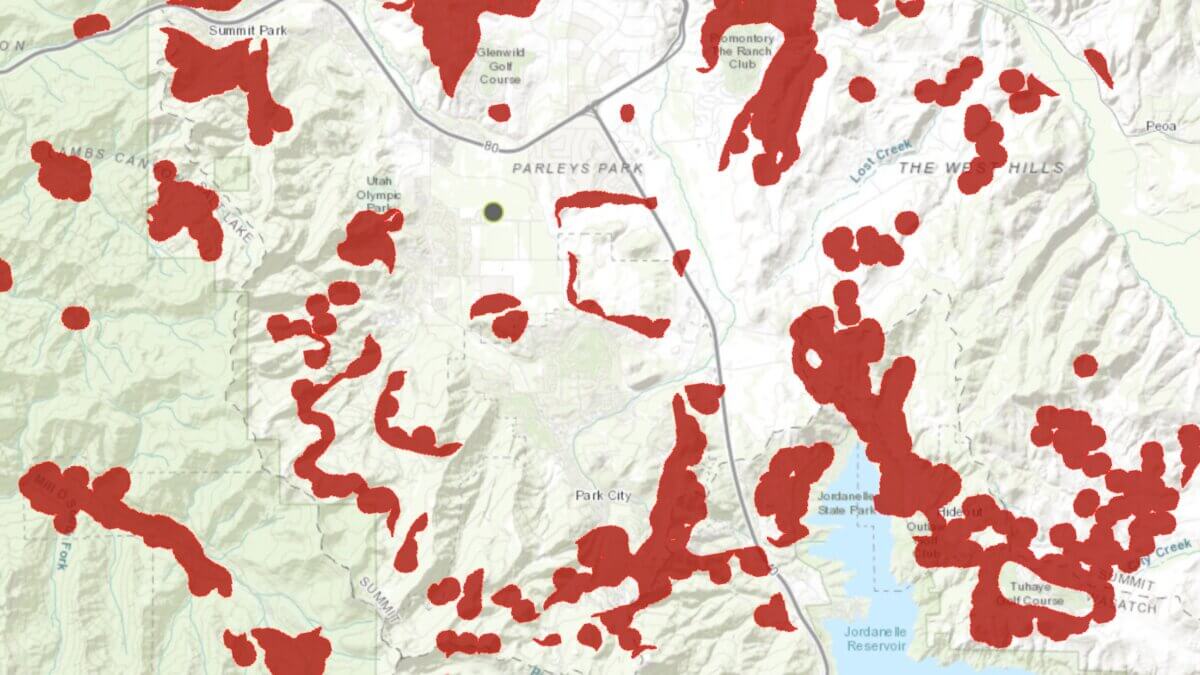

The newly released map is accessible via the Utah Wildfire Risk Explorer and outlines properties included in the state's high-risk WUI classification. This fee is applicable solely to taxable structures and not to vacant land. Funds collected will support Utah's new Wildfire Preparedness Program.

Homeowners can now ascertain which neighborhoods will be affected by the fee. In Summit County, for instance, many homes in upper Summit Park fall within the designated high-risk area. Some properties bordering developments like Promontory and Tuhaye are also included in the WUI fee zone. Conversely, more populated areas such as Park City and the Snyderville Basin are generally exempt from this fee.

The annual fee will vary from $20 to $100 per property based on the structure's square footage during the program's initial two years. Homeowners within the high-risk boundaries can anticipate notifications regarding the fee by early 2026. Starting in 2028, properties that do not undergo a lot-level wildfire risk assessment will automatically be classified at the highest risk level.

State officials have stated that the program aims to fund wildfire preparedness while encouraging homeowners in high-risk areas to take proactive measures against fire exposure. The law also stipulates that property insurers must consider the state’s high-risk WUI boundary when determining rates or renewal decisions, aiming for greater consistency and transparency in insurance practices.